Digital Signage Powers Up Bank Transformation

by Esther Chew

Digital Signage Powers Up Bank Transformation

by Esther Chew

Bank digital signage solutions are especially critical in providing real-time information (e.g. forex rates) to customers and upsell/cross-sell retail banking services.

The Impact

According to a survey of large to medium-sized banks around the world, 9 out of 10 say that digital signage is important for in-branch marketing. Roughly 50% of all the financial institutions felt moderately satisfied with the deployment of digital signage in banks, while two in five were highly satisfied.

Australia is one of the strongest emerging markets adopting digital signage efficiently in the banking and financial sector. The Australian banks are moving towards rapid digitalisation, using seamless technological advancements to ensure better internal and external operations. The overall retail banking income of the Australian banks is set to be $47.1 billion.

Trust, social responsibility and brand image are the key factors that influence customers’ association with a bank.

Here are several ways how digital signage solutions for banks can build a positive brand image:

Real-time Updates:

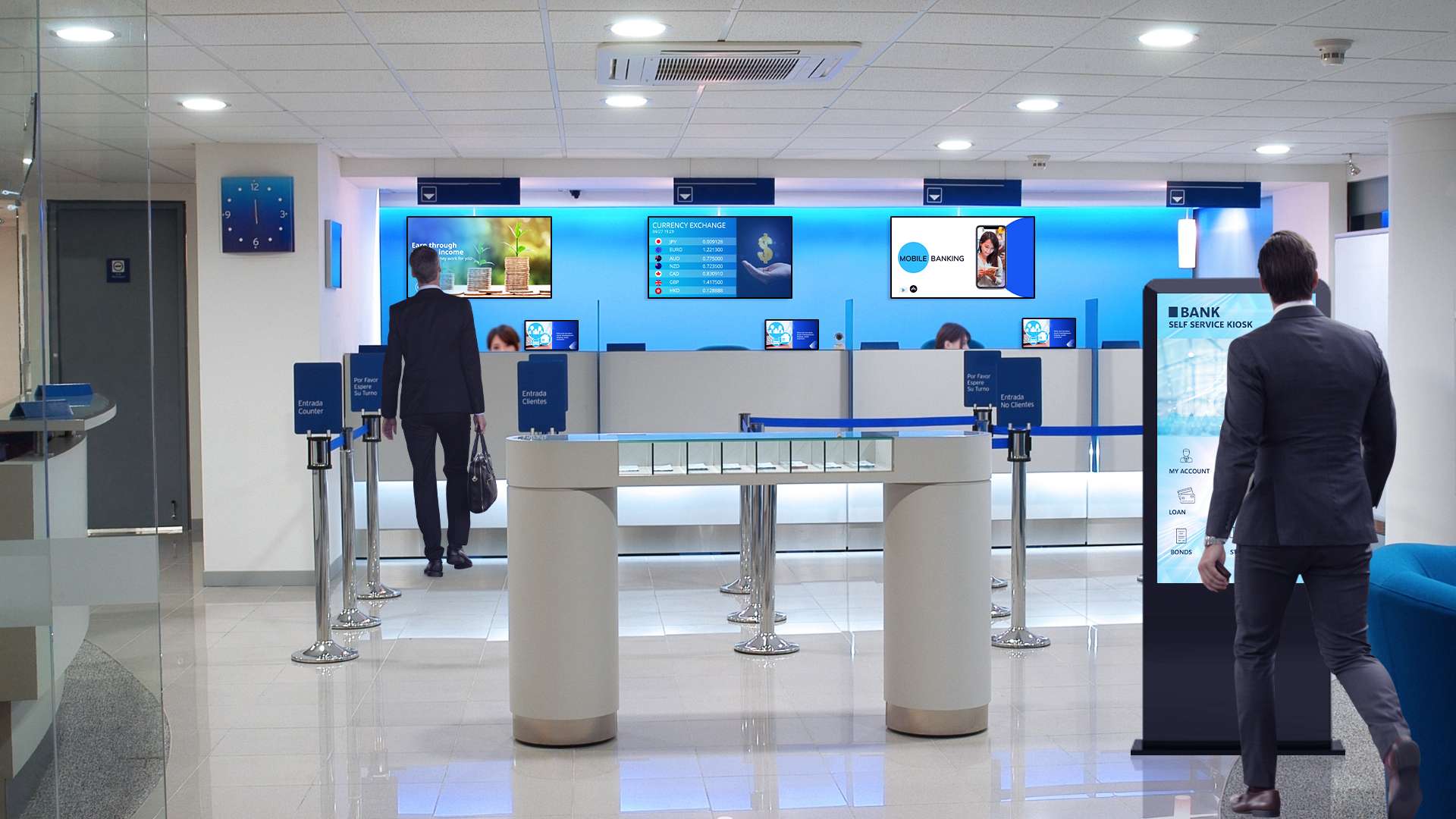

Digital signage for banks can display critical real-time information such as currency exchange rates, interest rates on investments, and present stock prices, to keep customers updated.

Elevate Customer Experience:

Customer experience accounts for 55% of loyalty. One way banks can enhance the customer experience is by leaning into technology and offering solutions such as digital kiosks to help clients access their personal account and access various services provided by the banks. This function contributes to a more interactive customer experience.

Boost Branding & Promote Products:

With its ability to display dynamic interactive content, bank digital signage can be capitalised to promote banking products and services to a captive audience. The bank’s vision, mission and value proposition can also be prominently displayed on large digital displays to foster a consistent brand image.

Efficient Queue Management:

Interactive digital displays engage customers with useful information like weather information, entertainment, news or trivia, and more, thus reducing the perceived waiting time.

Enrich Corporate Communication:

Internal communication can be boosted through bank digital signage. A centrally controlled content management system allows content on multiple screens across branches to be updated with ease. Instead of starting email threads, or updating information on rarely visited portals, corporate messages can be shared with all the branches simultaneously using digital signage to train employees, impart product knowledge, and provide important updates.

Enable Personalisation:

Sensor and artificial intelligence technologies help banks to tailor specific messages according to audience personas. Personalised messages can be sent to customers’ mobile devices to update them on the latest promotions or provide details on a specific product which they are interested in.

Understanding Customer Behaviour

Digital signage solutions for banks are continuously evolving to unveil crucial customer information based on behaviour, attention time and facial gestures.

In-branch data such as footfall, dwell times and paths can be harnessed to understand customer behaviour — bridging mobile, place-based media and a 360 degree customer view. With this deep customer insight, banks can map each aspect of the customer experience, streamlining optimization strategy and triggering smart messaging and relevant content on visual display and mobile.

Case study in Australia

The National Australia Bank (NAB) stores in New South Wales and Victoria are “smart stores” which are completely technology enabled without any in-store tellers. They have an array of intelligent machines and kiosks placed in front of the store. Customers can easily process the needed information without the need to queue for hours.

Transform your banking experience with digital signage

Scala provides effective and reliable digital signage solutions for banks, which helps to increase product awareness, elevate customer experience, and drive profits. To find out more about Scala’s digital signage banking solutions, visit here.

About the Author:

Esther Chew is the